![[feature] 11 Purchases You Can Do Less to Save Money](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjDZiu5bk7QBjrA40n6q773aEiBlOD40YI9hXMTD2TWE6LTKo3_RpJUEaKFmirmsOenkvEtYQAPLsO7eyedmiB-3gBR_jHyaqfB8rVha3W3pWrsmrNBEO0T-z_m82Ws8QNxcNiBw_uipSKwvTKfvxftviWC4PRuS3RWvOsstkL_6bZkrKAO8_LlWOoV/s16000/Save-Money.jpg) |

| Ⓒ Provided by Reader's Digest |

By Elizabeth Flaherty, Reader's Digest

Cut these simple things out of your life and you'll be amazed at how much money you can save.

Television cable

|

| Ⓒ Provided by Reader's Digest |

Cancel your cable bill. With services like Hulu, Netflix, and Amazon Prime Video, you can now watch almost anything immediately, and for a fraction of the cost of cable TV. Options such as HDTV antennas and YouTube TV work for those who love live TV, too.

Read More: 12 Budgeting Myths You Need to Stop Believing

Plastic baggies

|

| Ⓒ Provided by Reader's Digest |

Sure, plastic baggies are incredibly convenient, and we’ve gotten into the habit of buying box after box. But these reusable baggies cost about as much as a big pack of sandwich bags and are easy to wash and re-use. They seal well and are biodegradable, while typical plastic bags may spend 500 to 1,000 years or longer in a landfill.

Impulse purchases

|

| Ⓒ Provided by Reader's Digest |

We’re not just talking about the items that catch your eye as you shop hungry or wait in the checkout line—but certainly resist those too. All the time we spend online makes it easy to see something we never knew we wanted and then, thanks to a few touches and swipes, have it heading our way within minutes. Make a rule that all items must sit in an online shopping cart for a minimum of one day before purchase. Bonus: Some companies offer you a discount when they notice you haven’t yet pulled the trigger. (Though be sure that in the end, need, not that discount, informs your decision.)

Read More: 7 Ways Coupons Waste Your Money and Time

Unnecessary groceries

|

| Ⓒ Provided by Reader's Digest |

A recent study at the University of Vermont found that the average American wastes nearly a pound of food daily. That’s bad news for your wallet and the environment. Some tips to help: Plan your meals weekly, keeping what you already have on hand in mind, and make a grocery shopping list to support it. Stick to that list and shop smart when you do. Get creative with leftovers and using your freezer. (For example, a running stash of about-to-turn fruits and veggies make perfect smoothie starters.)

Paper towels and napkins

|

| Ⓒ Provided by Reader's Digest |

A 36-pack of microfiber cloths costs you about the same as a 12-pack of paper towels, but it will last you way longer. Invest in a stash of pretty cloth napkins, too. Keep a mini hamper under the sink to corral the dirties—and effectively keep paper products out of your kitchen.

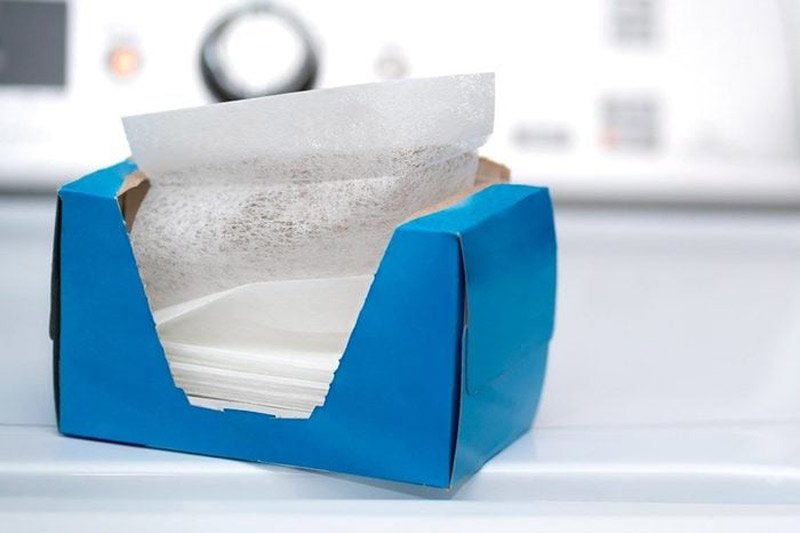

Dryer sheets

|

| Ⓒ Provided by Reader's Digest |

Invest in a few reusable wool dryer balls instead. You’ll save money on repeat dryer-sheet purchases, plus you’ll cut down on dry-time by up to 40 percent, according to the dryer-ball manufacturer (which then saves on energy costs).

Greeting cards

|

| Ⓒ Provided by Reader's Digest |

All those $3 and $5 purchases really do add up. Switching to free ecards instead of sending across the miles saves you money on postage, too—Smilebox, justWink, and PaperlessPost are some popular options. Can’t stand the thought of not giving them something to have and to hold? If making cards is up your alley, go for it! (Hold an afternoon card-making session to build up a stash.) Or, just buy an inexpensive box of all-occasion cards, and you’re good to go for years to come.

Meals out

|

| Ⓒ Provided by Reader's Digest |

Dining out is more than a $3,000 annual expense for most American households, according to the Bureau of Labor and Statistics. While no one wants to give up going out altogether, there are all kinds of ways you can bring that number down. Plan to take lunch to work or school more often. (Make it fun so it doesn’t feel like you’re skimping.) Go out during happy hour, meet for lunch instead of dinner, or opt for an appetizer potluck at home instead of an evening out once in a while.

Apps and in-app purchases

|

| Ⓒ Provided by Reader's Digest |

Schedule some time to review your app subscriptions and quit any you no longer use. (Subscriptions that are automatically billed each month are easy to forget about.) If there are any you do use that have a particularly high in-app purchase rate—Candy Crush, we’re looking at you—research free or low-cost replacements. You could also set a monthly limit that you’re comfortable with, and disable in-app purchases once you’ve met it. And here’s an idea: Use apps to save money instead. Apps like You Need a Budget and Mint are designed to do just that.

Bottled and canned water

|

| Ⓒ Provided by Reader's Digest |

If you haven’t already, it’s time to stop paying nearly $4 for a bottle of water when you can get it at home for virtually nothing. If you’re concerned about taste or quality, invest in a water filter and reusable water bottle. Canned sparkling water isn’t exactly cheap, either. If you’ve developed a fizzy-water habit, consider an every-other rule to help you cut back: Drink a glass of regular water between every can.

Name-brand items

|

| Ⓒ Provided by Reader's Digest |

While it’s true that some generics items don’t compare quality-wise to their higher-priced brand-named counterparts, it’s also true that some generic products are literally identical. This is true of hundreds of items, including patent medicines, food, household items, and more.

Read More: 15 Ways To Save Money on a Low Income

See more at Reader's Digest